AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: 290.00 (IA)

US Trade - Heifers

Rail: 290.00 (IA)

Canadian Dollar

0.02

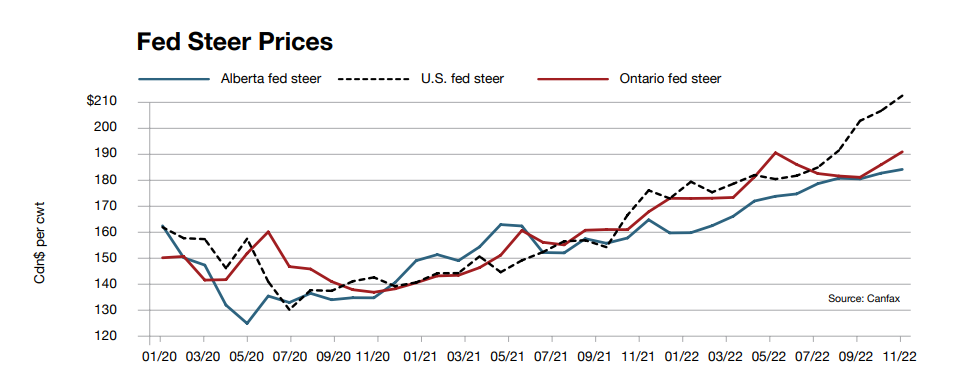

CME drives fed prices higher, carcass quality higher

The CME live cattle futures market climbed steadily in the last half of 2022. Combined with the

weakening Canadian dollar, Alberta fed cattle prices re-visited late 2014 levels, right before the 2015

price surge. Alberta fed steers averaged $184/cwt live in December, 15 per cent higher than January. On average, fed steer prices rose 1.3 per cent per month.

Alberta and Saskatchewan cattle on feed numbers in July 2022 were 5 per cent higher than July 2021. From August to December, the number of cattle on feed averaged 5 per cent lower than year-ago levels. These larger first-half numbers have kept western cattle at a discount to U.S. fed cattle for the entire second half as cattle placed on feed in July are only now leaving feedlots. Using lift time as a metric for how current packers are taking delivery of fed cattle, Alberta packers extended the time between purchase and delivery in the fourth quarter, whereas Ontario shortened the time between purchase and delivery in December. This hand-to-mouth supply that Ontario packers face has pushed Ontario fed cattle to a $7/cwt premium over Alberta fed cattle in December, compared to less than a $1/cwt premium in October.

The Alberta to Nebraska cash basis averaged -$26/cwt in the fourth quarter of 2022, the weakest quarterly average since the second quarter of 2005. The five-year historical cash basis for Alberta is -$4/cwt, and Ontario’s basis in 2020 and 2021 is -$3/cwt in the fourth quarter. Canadian steer carcass weights averaged 960 lbs in the fourth quarter, 17 lbs heavier than last year and almost 30 lbs heavier than the five-year average. Large carcass weights left the leverage with the packer, a contributing factor to the weaker basis levels. The weak basis encouraged fed cattle to go south with exports up 1 per cent in October and 3 per cent in November.

Heavier carcasses contribute to larger beef production as well as typically supporting grading quality. Western steer carcass weights reached 980 lbs the last week of October. However, cold weather throughout the Prairies helped drop average carcass weights to 947 lbs by year-end.

In the fourth quarter, all 13 weeks saw 75 per cent or more of all Grade A carcasses grade AAA or Prime, including one week at 80 per cent. During the same period in 2021, there were only six weeks at 75 per cent or more carcasses graded AAA or better. In 2022, 75 per cent graded AAA or Prime up from 71.5 per cent the prior year. In 2022, the increase in quality grading added 89.1 million pounds or 5 per cent to the supply chain. Stable to higher prices suggest continued strong demand for quality beef.

For ongoing market analysis and to become a Canfax member, visit www.canfax.ca.

This article was first published in Volume 3 Issue 1 of ABP Magazine (February 2023). Watch for more digital content from the magazine on ABP Daily.

Leave a Comment

Add abpdaily.com to your home screen

Tap the menu button next to the address bar or at the bottom of your browser.

Select ‘Install’ or ‘Add to Homescreen’ to stay connected.

Share this article on

About the Author