AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: 290.00 (IA)

US Trade - Heifers

Rail: 290.00 (IA)

Canadian Dollar

0.02

A Time to Build: An outlook for 2023

The wise King Solomon suggested “There is a time for everything, and a season for every activity…” The Byrds song “Turn! Turn! Turn!” in the 1960s famously alluded to Solomon’s words as a way to draw attention to switching mindsets from focusing on war to focusing on peace.

Within Solomon’s verses are also the phrases: “a time to plant, and a time to uproot” and “a time to tear down, and a time to build.” The question we should ask ourselves at the start of this new year is what do we need to “uproot” and “tear down” in order to “plant” and “build?”

The cattle market looks poised for a multi-year rally based on supply fundamentals, but few seem prepared to take advantage of it. In order to take next steps, sometimes we need to uproot, tear down old mindsets and roadblocks, and capture the new winds rattling our sails.

Here are six themes for the upcoming year to assist in processing what we should “tear down” and “uproot” and what we should “plant” and “build.”

Theme 1: We are in a bull market for cattle – build

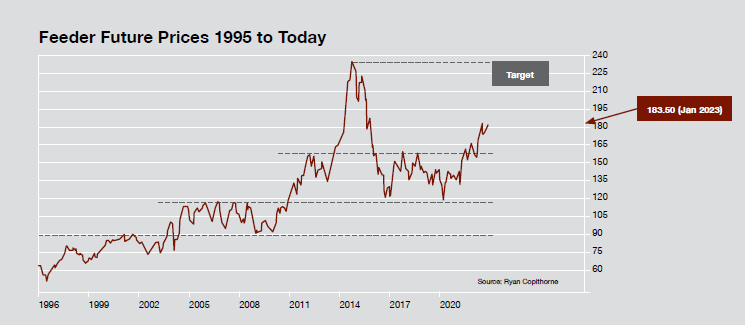

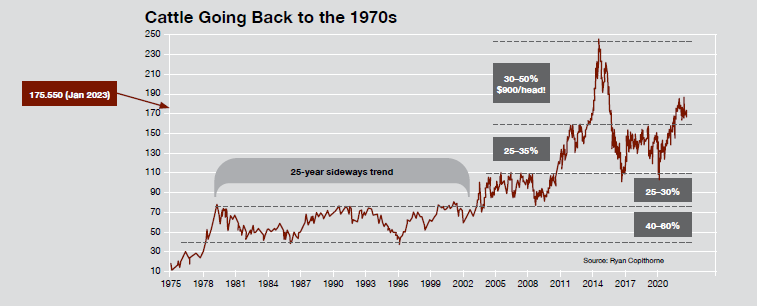

The last seven years have been a slog for cattle prices. A major seven-year bottoming formation in cattle prices. This year broke ground into a new trading range. The futures market is pulling us higher, driven by decreasing cow herd inventories amid relatively strong beef demand and exports out of both the U.S. and Canada.

As prices grind higher, we may look back at 2022 and ask why we didn’t load up on more of those $1,200 heifer calves or $1,200 bred cows. The range highs for this new trading zone price $2,000 calves, likely $3,500 bred cattle, 8-weight steers at $2,800, and fat steers at $3,500 using current dollar and futures prices. If prices rise this year, it will be expensive to expand later. The time to “build” numbers is now.

Theme 2: With good prices comes more risk

As the price to sell cattle rises, unfortunately, so will the cost to purchase or own cattle. The trading range we are moving into is a very wide range (nearly $900 per head range high-to-low for an 850 lb steer). Riding the risk may be one of the things you consider “uprooting.” It will be critical to manage when you buy and sell, and have a risk management plan as markets could be volatile. Cattle prices are rising amid an era of potential recessions, rising interest rates, wars, and rumours of wars. Be careful to lock in good forward prices when and where possible. The road higher will be rocky.

Theme 3: The scramble for “real things”

The world population just hit 8 billion people last fall. Commodity prices relative to other asset classes are at the lowest levels in more than 50 years. The last time commodities were near this cheap was the start of the great commodity rallies of the 1970s and the early 2000s.

Cattle are a commodity, as are grains. In these cycles, the world begins to de-prioritize things like stocks, bonds, technology, crypto, and other hype items of the recent past, and focus on “real things” that hurt if you drop them on your foot, like food, energy, and materials. Interest rates generally rise in these environments. What that means is cattle demand and prices may rise, but so will input prices, so we will have to manage our requirement for inputs.

The “planting” and “building” will be building your herds ahead of the rally. The “uprooting” and “tearing down” will be cutting your need for inputs and interest rate sensitive items.

Find ways to let cows feed themselves where possible. Reduce debt levels by cutting equipment and overheads. Find ways to use cover crops and cattle to reduce fertilizer usage. Own appreciating assets, not depreciating ones. Simplify systems to reduce labour costs. Keep cattle on ranches longer to cut transportation and sales transaction costs. Own more yearlings and less cows as a drought proof, etc.

One last point: these commodity cycles don’t go up in straight lines! There will be setbacks in prices along the way. Use these setbacks to stock up on inputs or expand your herd.

Theme 4: Packer leverage

U.S. packing capacity has been chronically restricted relative to fed cattle numbers in the United States since 2015. That trend is ending. New packing space is being made available in the U.S. 8-10,000 head/day of new packing space is coming online in the next few years while cattle inventories are dropping.

Excess packing capacity in Canada has brought cattle north in the last seven years at an astounding rate. That too will reverse as capacity opens in the U.S. Feedlots and packers in Canada will be challenged to find inventory to keep full. Producers could now have leverage to demand higher prices and possibly more options owning product through to retail. Uproot old mindsets of being price-takers and consider what made-in-Alberta solutions ranchers can plant or build with this new leverage.

Theme 5: Carbon

The unspoken reality is that grasslands in Canada sink enough carbon each year to exceed Canada’s 2030 carbon reduction goals of somewhere near 227 million MTs. Statistics Canada’s 2021 farmland survey shows 12 million acres of tame or seeded pasture and 34 million acres of natural pasture in Canada. If this is sinking likely at least a tonne of carbon a year, that is 46 million tonnes of carbon sunk by pasture and haylands in Canada per year. It would take less than five years to offset Canada’s carbon reduction plan with on-farm grasslands alone should we measure and recognize it.

At $50/tonne carbon, Canada’s on-farm grassland carbon sink is worth likely at least $2.3 billion dollars. Sinking four tonnes per acre of carbon at $50/tonne with improved pastures could add $200/acre of carbon value to the soil through management. Are we as an industry doing everything we can to ensure ranchers will capture this value in order to preserve grasslands in Canada? What other ecosystem services are we providing as well?

One thing we don’t want to do is “uproot” or “tear down” our grasslands in this country. Hopefully we can find a solution to compensate and incentivize ranchers for “planting” and “building” it.

Theme 6: Tell our story

Lastly, on the theme of “building” and “planting,” are there new ways this year to tell our unique beef production story? In order for ranchers to tell their story, they need to control the marketing and messaging through to the consumer. If ranchers have no access to this option, the story will not be told properly. Let’s focus this year on more solutions for ranchers to have the option to own more product and messaging through to retail. Get the next generation involved here! We need their voice!

All the best this year. Ride the bull market, don’t get bucked off, and remember now is the time to build and plant ahead of the rush while uprooting and tearing down old traditions, mindsets, or hindrances that may be holding us back from this future.

This article was first published in Volume 3 Issue 1 of ABP Magazine (February 2023). Watch for more digital content from the magazine on ABP Daily.

Leave a Comment

Add abpdaily.com to your home screen

Tap the menu button next to the address bar or at the bottom of your browser.

Select ‘Install’ or ‘Add to Homescreen’ to stay connected.

Share this article on

About the Author

Ryan's career has involved managing and operating a large historic family ranch as well as building one of Canada's largest multi-ranch cow/calf programs. His current company is called Cows in Control, a company designed to focus on providing financial and risk management advice to farmers to protect the value of their commodities and inventories. Ryan has an MBA from Queen's School of Business, a finance degree, and over 25 years in the ranching and farming business.