AB Direct - Steers

Rail: ---

AB Direct - Heifers

Rail: ---

US Trade- Steers

Rail: 290.00 (IA)

US Trade - Heifers

Rail: 290.00 (IA)

Canadian Dollar

0.02

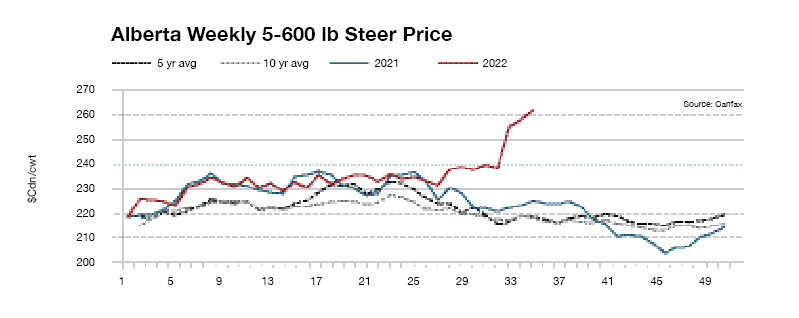

Supplies start to tighten heading into the second half of 2022

Cattle on feed numbers have started to tighten with smaller placements in June and July, resulting in the August 1st inventories being below year ago levels for the first time in over a year. While they remain above the five-year average, fed cattle marketings are expected to tighten throughout the second half of the year and be below 2021 levels in the fourth quarter. Fed cattle prices are projected to increase throughout the second half, with some classes of cattle being back in the black, on a cash basis, by the fourth quarter. The July 1st feeder and calf supply outside of feedlots is down 283,710 head from last year, pointing towards tighter supplies to fill pens; unless the west becomes a net feeder importer again.

In June, western Canada received a billion-dollar rain that has supported pasture conditions and improved the outlook on feed grain production. Feed grain prices eased lower throughout July and August, supporting the feeder market. Alberta calf prices took a sharp jump higher mid-August to reach $255-260/cwt. This was well before the market could support such prices, which were projected to happen by late November. Therefore, feedlot purchases are currently in red and need live cattle futures to move higher to support them. Calf prices are currently set to stay steady or move counter-seasonally higher throughout the fall run as long as feed prices stay stable or move lower. The big risk to the feeder market is any upward pressure on feed prices this fall.

Alberta cow prices reached $115/cwt in late August at the strongest levels since October 2015. Cow marketings are up again this year with slaughter up 4% YTD and live exports up 19%. While the west is seeing cow slaughter up a modest 1%, larger numbers are headed south with live exports up 88%. This is occurring as packers in the west are prioritizing fed cattle through the system; while the US has dedicated cow plants and are taking more, even with enhanced domestic cow marketings. Larger Canadian cow marketings combined with larger heifer placements into feedlots point towards a smaller cow herd on January 1, 2023.

For ongoing market analysis and to become a Canfax member, visit: www.canfax.ca

This article was first published in Volume 2 Issue 4 of ABP Magazine (October 2022). Watch for more digital content from the magazine on ABP Daily.

Leave a Comment

Add abpdaily.com to your home screen

Tap the menu button next to the address bar or at the bottom of your browser.

Select ‘Install’ or ‘Add to Homescreen’ to stay connected.

Share this article on

About the Author

Brenna Grant is Manager of Canfax Research Services, where she monitors data from national statistics; oversees the development of new economic models to make annual outlooks and evaluate the impact of management decisions on cost of production. Brenna grew up in SW Saskatchewan on a cow/calf, yearling grasser operation where her family still operates. She holds a BA in Agricultural Economics from the University of Saskatchewan and a Masters in Applied Economics from Montana State University.